Introduction – Why Tariffs Are Eating Everyone’s Lunch

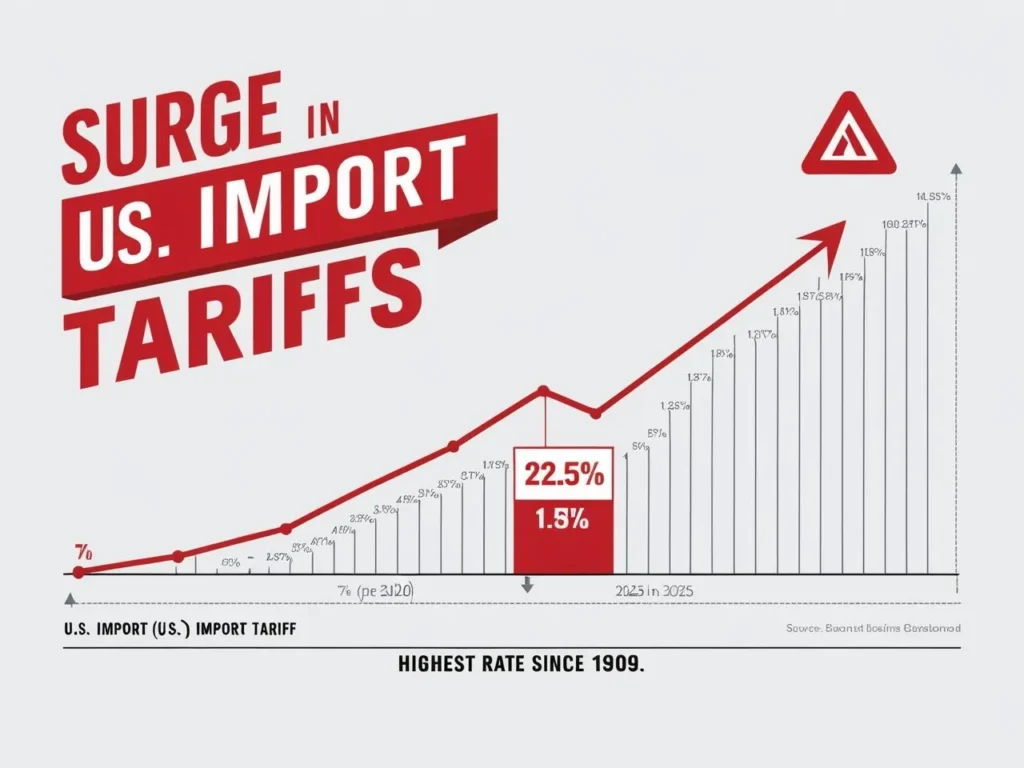

U.S. import duties now average 22.5 %—the steepest rate since 1909. If the next wave of “reciprocal tariffs” takes effect, the burden could reach ≈ 28 %. Economists warn that will:

- Push consumer prices up about 3 %

- Drain ≈ $4,900 from the average household’s annual budget¹

Rather than surrender margin or hike prices, savvy makers are printing products on U.S. soil, on demand, and pocketing every dollar otherwise lost to duty, freight, and bulk inventory. This guide shows you how to cost‑justify, launch, and scale a tariff‑proof product line—from first CAD sketch to micro‑factory.

The Tariff Pressure Cooker

| Metric | Pre‑2020 | 2025 (Apr 2) | Possible 2025 (H2) |

|---|---|---|---|

| Avg. effective tariff | 7–8 % | 22.5 % | 27–28 % |

Source: Yale Budget Lab²; The Guardian³

- Household impact: $3,800–$4,900 a year; ~3 % CPI bump

- Small‑seller squeeze: Import‑heavy SKUs lose 10‑15 % margin overnight.

“Tariffs are a tax paid by Americans, not foreigners. Businesses must innovate or eat the loss.” — Ernie Tedeschi, Yale Budget Lab⁴

3D Printing 2025: Goodbye “Prototype Island”

- Desktop AM market projected at **$9.16 B by 2029 (CAGR 16.8 %)**⁵

- 3D Printing Industry survey: *“2025 marks the leap from prototypes to production.”*⁶

- Mature tool‑chains (FDM, resin, SAF, SLS) now deliver end‑use plastics tough enough for consumer goods and aerospace ducts.

Why it matters: Low‑volume, high‑mix manufacturing crushes landed‑cost math when tariffs swell imports.

Tariff‑Proof Economics – Your Break‑Even Calculator

| Cost Bucket | Import Route | On‑Demand 3DP |

|---|---|---|

| Unit cost | Factory ex‑works + ocean freight | Material + machine time + labor |

| Up‑front | Molds/tooling ($5k–$50k) | $0 |

| Duty | 12–28 % ad valorem | $0 |

| Transit | 30–45 days | 1–3 days (domestic) |

MakerVerse finds additive beats injection molding up to ≈ 5,000 units, and dominates foreign sourcing below 500 pcs when tariffs > 20 %⁷.

3DP Cost / unit = material $ + (machine hr × rate) + (labor min × rate)

Import Cost / unit = (FOB $ + freight) × (1 + tariff %) + port fees

When the curves cross, you’ve found your tariff‑proof sweet spot.

Five Traits of a Killer 3D‑Printed SKU

- Newly tariffed HS code (plastics, kitchenware, toys)

- < 200 mm footprint—fits desktop beds

- Customizable look or ergonomics

- ≥ 4× material cost gross margin

- Lead‑time sensitive (spares, cosplay parts, trend merch)

Examples: custom phone grips, ergonomic spatulas, cosplay armor shards, drone motor mounts, specialty pipe fittings.

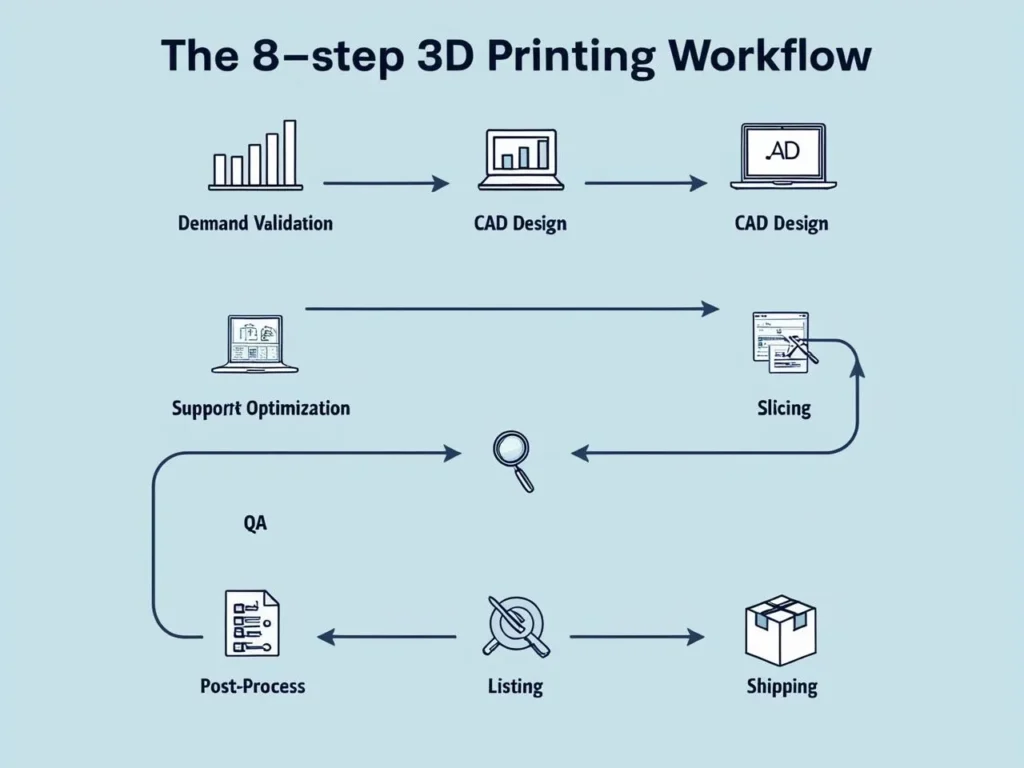

From CAD to Checkout – 8‑Step Rapid Workflow

- Validate demand (Google Trends, Etsy autocomplete)

- Parametric CAD in Fusion 360

- DFAM tweaks: orient for strength, kill supports

- Slice & cost in PrusaSlicer → print‑time + material grams

- Print & QA first article (calipers + visual)

- Post‑process (vapor smooth, dye, plate)

- List online with SEO‑rich copy + tariff‑proof story

- Pick‑pack‑ship in ≤ 48 h via ShipStation

Pro tip: The entire loop fits in one weekend once templates are dialed.

Gear & Materials: A Lean Buyer’s Guide

| Category | Budget | Picks |

|---|---|---|

| Prosumer FDM | $1k–$3k | Bambu X1C, Prusa MK4 |

| Resin desktop | $600–$2k | Elegoo Saturn 4K |

| Industrial nylon | Outsource | U.S. SLS/SAF farms |

| Filaments | $20–$80 /kg | PLA+, PETG, PA‑CF |

Lease or job‑out metals until volume justifies $20k+ machinery.

Compliance & Quality—Pass Every Test

- Standards: ASTM F3091, ISO/ASTM 52900

- Dimensional QC: handheld laser scan ± 0.1 mm

- CPSC filings: kids’ products → provide SDS + strength data

- Electronics shells: certify finished device to UL/FCC

Document each step—auditors love traceability.

Story & SEO: Sell the “Made‑Here, On‑Demand” Edge

- Headline your listings with “Tariff‑Free, Printed in USA”.

- Publish an interactive cost‑savings calculator (magnet for backlinks).

- Share TikTok timelapses—nothing converts like watching a product materialize.

- Add

Product+FAQPageschema to win rich snippets.

Scaling: Desktop Rig → Micro‑Factory

- ~10 k units/yr: Farm of five Core‑XY printers, automated plate swap

- ~50 k units/yr: Invest in SAF or MJF powder‑bed—7 ¢/cc nylon parts

- Regional demand spikes: Tap distributed partners (Replique, MakerVerse) to print closer to customers—zero inventory, zero duty.

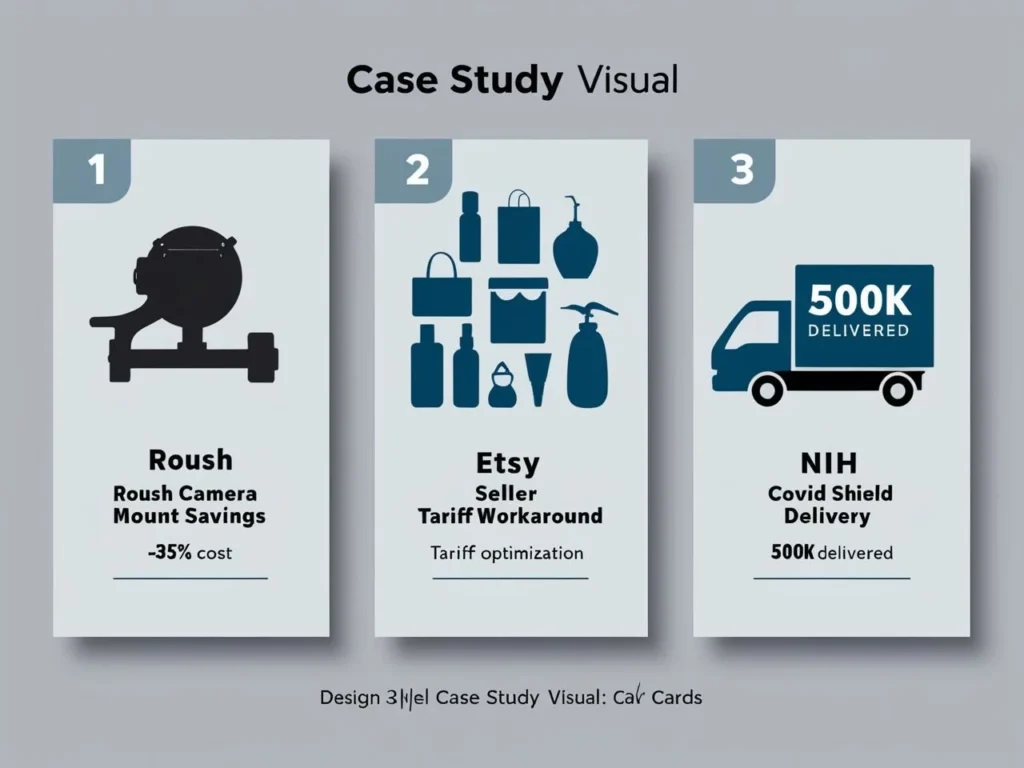

Real‑World Wins

- Roush Performance cut 35 % per‑unit cost on Ford truck camera mounts via Stratasys SAF⁸.

- A U.S. Etsy phone‑grip seller dodged a 25 % plastics tariff by printing inserts locally—then charged extra for name engraving (3DPrint.com case study).

- During COVID, the NIH/FDA/America Makes network delivered 500 k printed face‑shield frames to hospitals nationwide⁹.

Common Pitfalls & Quick Fixes

| Mistake | Why It Hurts | Fast Fix |

|---|---|---|

| 8‑hour monolith prints | Wasted uptime | Hollow, split, variable infill |

| Ignoring post‑process cost | Hidden margin leak | Time‑study sanding/dye |

| $200 hobby printers | Reliability nightmares | Upgrade to prosumer w/ telemetry |

| Unlimited customization | Support overload | Offer 3‑choice menu |

Conclusion & CTA

Tariffs aren’t leaving—and may climb higher. On‑demand 3D printing turns trade pain into entrepreneurial gain: zero molds, zero cargo delays, zero duties—just digital files converting to revenue overnight.

Footnotes / Sources

- Yale Budget Lab (2025 tariff impact study)

- Ibid.

- The Guardian, “Reciprocal Tariffs Could Hit 28 %,” Apr 2025.

- NBC Connecticut interview with Ernie Tedeschi, May 2025.

- The Business Research Company, “Desktop 3DP Market Forecast,” 2024.

- 3D Printing Industry Exec Survey, Jan 2025.

- MakerVerse White Paper, “Additive vs. Injection: The 5 k Unit Threshold,” 2024.

- Stratasys Case Study, Roush Performance, 2023.

- NIH 3DP Exchange / FDA, “COVID‑19 Supply Chain Response,” 2020.

FAQs

A tariff-proof product line is a business strategy where goods are produced domestically—often using on-demand 3D printing—to avoid paying high import duties. By manufacturing locally, companies can eliminate overseas shipping delays, reduce costs, and bypass tariffs that would normally apply to imported products.

3D printing allows businesses to manufacture products domestically, sidestepping tariffs that apply to foreign-made goods. With U.S. import duties averaging 22.5% in 2025, printing locally on demand helps reduce landed costs, speed up delivery, and retain higher profit margins.

Yes. When accounting for tariffs, tooling costs, and freight, on-demand 3D printing can be more cost-effective for low to medium production volumes. It eliminates mold expenses, reduces lead times, and avoids import duties—especially when tariffs exceed 20%.

Ideal 3D printed products include those with small footprints, customization potential, time-sensitive demand, and high-margin potential. Examples include custom phone grips, ergonomic tools, cosplay accessories, drone parts, and specialty plastic components.

Begin by validating product demand, designing in parametric CAD software, optimizing for print, and using desktop FDM or resin printers. Follow an 8-step workflow from slicing to shipping. Start small and scale up to a micro-factory setup as volume grows.